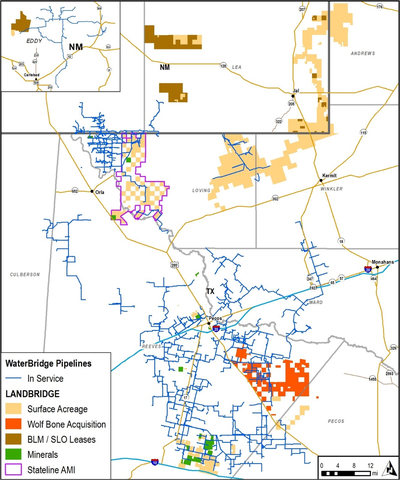

HOUSTON–(BUSINESS WIRE)– LandBridge Company LLC (NYSE: LB) (“LandBridge,” “we” or “our”) today announced it has closed its previously announced acquisition of approximately 46,000 largely contiguous surface acres, known as the Wolf Bone Ranch, in the Delaware Basin from a subsidiary of VTX Energy Partners, LLC, a Vitol investment (“VTX Energy”).

(Graphic: LandBridge)

(Graphic: LandBridge)

The Wolf Bone Ranch acquisition strategically expands LandBridge’s position in Reeves and Pecos Counties, Texas, an important region for both oil and natural gas production, and provides access to the Waha Gas market hub. The land generates significant cash flows from existing third-party operations and is strategically located to capture potential future growth opportunities from renewable energy projects, commercial real estate and digital infrastructure development. As part of the acquisition, LandBridge secured a minimum annual revenue commitment of $25 million for each of the next five years from VTX Energy and its affiliates that includes surface operations, brackish water used for completions and produced water handling royalties. LandBridge funded the purchase price of the acquisition with $200 million of proceeds from the Private Placement (defined below) and $45 million of borrowings under its debt facilities.

LandBridge re-affirms its recently increased 2025 Adjusted EBITDA1 guidance of $170 million to $190 million, which includes expected earnings accretion from the Wolf Bone Ranch acquisition.

Contemporaneously with the acquisition, LandBridge closed the previously-announced private placement of Class A shares representing limited liability company interests (the “Class A Shares”) at a price of $60.03 per Class A Share to select institutional and accredited investors (the “Private Placement”). Approximately $150 million of proceeds from the Private Placement were used to purchase units representing membership interests in DBR Land Holdings LLC (“OpCo Units”) held by LandBridge Holdings LLC, an affiliate of LandBridge’s financial sponsor, Five Point Energy (the “Repurchase”). A corresponding number of Class B shares representing limited liability company interests in LandBridge held by LandBridge Holdings LLC were contemporaneously cancelled.

There is no dilution to LandBridge shareholders with respect to the Repurchase of OpCo Units from LandBridge Holdings LLC. The securities offered in the Private Placement have not been registered under the Securities Act of 1933, or any state securities laws and may not be offered or sold in the United States absent registration or an applicable exemption from, or a transaction not subject to, the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), and applicable state law.

In conjunction with the Private Placement, LandBridge, its directors and executive officers and LandBridge Holdings LLC entered into lock-up agreements pursuant to which they are subject to a 60-day lock up from the date of closing.

Following the closing of the Private Placement and the Repurchase, LandBridge’s management team and Five Point Energy hold an approximate 70% ownership interest in LandBridge and its operating subsidiaries through LandBridge Holdings LLC.

In connection with the Private Placement, Goldman Sachs & Co. LLC acted as the lead placement agent and Barclays Capital Inc. acted as a placement agent. Kelly Hart Hallman LLP served as counsel to LandBridge for the Wolf Bone Ranch acquisition. Vinson & Elkins L.L.P. served as counsel to LandBridge for the Private Placement.

Piper Sandler served as financial advisor to VTX Energy and Vitol. Gibson Dunn & Crutcher LLP served as counsel to VTX Energy and Vitol.

About LandBridge

LandBridge owns approximately 273,000 surface acres across Texas and New Mexico, located primarily in the heart of the Delaware sub-basin in the Permian Basin, the most active region for oil and natural gas exploration and development in the United States. LandBridge actively manages its land and resources to support and encourage oil and natural gas production and broader industrial development. Since its founding in 2021, LandBridge has served as one of the leading land management businesses within the Delaware Basin. LandBridge was formed by Five Point Energy LLC, a private equity firm with a track record of investing in and developing energy, environmental water management and sustainable infrastructure companies within the Permian Basin.

About Five Point

Five Point Energy is a private equity firm focused on building businesses within the environmental water management, surface management and sustainable infrastructure sectors. The firm was founded by industry veterans who have had successful careers investing in, building, and running midstream infrastructure companies. Five Point’s strategy is to buy and build assets, create companies, and grow them into sustainable enterprises with premier management teams and industry-leading E&P partners. Based in Houston, Five Point targets equity investments up to $1 billion and has approximately $7 billion of assets under management across multiple investment funds. For more information about Five Point Energy, please visit: www.fivepointenergy.com.

About Vitol

Vitol is a leader in the energy sector with a presence across the spectrum: from oil to power, renewables and carbon. Vitol trades 7.3 mmbpd of crude oil and products, and charters around 6,000 sea voyages every year.

Vitol’s counterparties include national oil companies, multinationals, leading industrial companies and utilities. Founded in Rotterdam in 1966, today Vitol operates from some 40 offices worldwide and is invested in energy assets globally including: 105 mmbbls of storage globally, roughly 850 kbpd of refining capacity, over 9,000 service stations and more than $2.5 billion committed to a growing portfolio of transitional and renewable energy assets. Revenues in 2023 were $400 billion. For more information about Vitol, please visit www.vitol.com.

Cautionary Statement Concerning Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements are based on LandBridge’s current beliefs, as well as current assumptions made by, and information currently available to, LandBridge, and therefore involve risks and uncertainties that are difficult to predict. Generally, future or conditional verbs such as “will,” “would,” “should,” “could,” or “may” and the words “believe,” “anticipate,” “continue,” “intend,” “expect” and similar expressions identify forward-looking statements. These forward-looking statements include any statements regarding the Wolf Bone Ranch acquisition, including the expected benefits of the expected accretion, integration plans, synergies, opportunities and anticipated future performance, and certain projections. These forward-looking statements are subject to a number of risks, uncertainties, and assumptions, many of which are beyond our control.

Forward-looking statements include, but are not limited to, strategies, plans, objectives, expectations, intentions, assumptions, future operations and prospects and other statements that are not historical facts, including our estimated future financial performance. You should not place undue reliance on forward-looking statements. Although LandBridge believes that its plans, intentions and expectations reflected in or suggested by any forward-looking statements made herein are reasonable, LandBridge may be unable to achieve such plans, intentions or expectations and actual results, and its performance or achievements may vary materially and adversely from those projected in this press release due to a number of factors including, but not limited to: our customers’ demand for and use of our land and resources; the success of WaterBridge and Desert Environmental LLC, in executing their business strategies, including their ability to construct infrastructure, attract customers and operate successfully on our land; our customers’ ability to develop our land or any potential acquired acreage to accommodate any future surface use developments; the domestic and foreign supply of, and demand for, energy sources, including the impact of actions relating to oil price and production controls by the members of the Organization of Petroleum Exporting Countries, Russia and other allied producing countries with respect to oil production levels and announcements of potential changes to such levels; our reliance on a limited number of customers and a particular region for substantially all of our revenues; our ability to enter into favorable contracts regarding surface uses, access agreements and fee arrangements, including the prices we are able to charge and the margins we are able to realize; our ability to continue the payment of dividends; our ability to successfully implement our growth plans, including through future acquisitions of acreage, and/or introduction of new revenue streams; and any changes in general economic and/or industry specific conditions, among other things. These risks, as well as other risks associated with LandBridge, are also more fully discussed in our filings with the U.S. Securities and Exchange Commission. Except as required by applicable law, LandBridge undertakes no obligation to update any forward-looking statements or other statements included herein for revisions or changes after this communication is made.

Non-GAAP Financial Measures

Reconciliations of forward-looking non-GAAP financial measures to comparable GAAP measures are not available due to the challenges and impracticability of estimating certain items, particularly non-recurring gains or losses, unusual or non-recurring items, income tax benefit or expense, or one-time transaction costs and cost of revenue. We are unable to reasonably predict these because they are uncertain and depend on various factors not yet known, which could have a material impact on GAAP results for the guidance period. Because of those challenges, a reconciliation of forward-looking non-GAAP financial measures is not available without unreasonable effort.

No Offer or Solicitation

This press release shall not constitute an offer to sell, or the solicitation of an offer to buy, the securities described herein, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

1 Adjusted EBITDA is a non-GAAP financial measure. See “Non-GAAP Financial Measures” included in this press release for related disclosures.

View full press release